Different markets = different payment methods

Farmers—and especially small farmers—often sell to live markets like farmers markets or fair stands. If you’re selling at an on-site market, you’ll need a way to accept payment for farm produce. Before you start collecting payments, spend some time to choose the right payment tool.

If you use a payment tool that’s hard to use or sort out the numbers later, then your finances will get messy. Messy finances and accounting can lead to missed payments, unpaid bills and lost credit accounts, overdrawn accounts, gaps in inventory, and potentially even bankruptcy.

That’s why it’s important to have clear and easy-to-use payment methods and processes.

In this post, we’ll explore the main methods for collecting payments in on-site markets. Each method has its own benefits, challenges, and special considerations.

The classics: cash and checks

Cash is the obvious choice for farmers. It’s easy to track and exchange and doesn’t require any more technology or fancy equipment.

It’s always recommended that businesses allow the option to make cash sales. (No reason to lose a sale because you can’t take cash!)

However, cash also has challenges. It can get cluttered and mixed up physically, and you have to have enough cash even at the beginning of sales to make change.

In some markets, fewer people will carry cash in hand (although farmers market goers do tend to carry cash with them). You should also have a way to make sure the cash is legitimate, and that can add a few seconds to transaction time.

Our recommendation:

Have the option to use cash. Use a “bank kit” (a set bag or box of change used for cash sales). It should include a fraud marker, change ($20–50 worth), receipt paper, pens, and a calculator.

Make receipts for your cash sales using carbon paper. At the end of the day, double check that your cash receipts total equals the amount in sales plus the change you started with. This keeps track of sales and cash and will keep you organized in a busy environment!

The close alternative to cash is checks.

There aren’t many big benefits to using checks. They’re tough to steal and people who don’t have cash might have checks. However, as a vendor, you are blind about the legitimacy of the check. There are several possibilities if someone hands you a check:

a) It’s their check, and it’s a good check: payment will go through.

b) It’s not their check: payment won’t go through.

c) It’s a bad check: payment will bounce.

To avoid situation B, you can verify their identity, but that takes time and slows down business. You can’t avoid situation C. This makes checks more risky to use.

Our recommendation:

Only use checks with customers you know and trust.

Some farmers use plain old cash and checks to receive payment from customers, but in some situations, it’s good to have other options. For example, many market-goers only carry a card for payment. By limiting payment to cash or check, you may be missing out on significant business!

The third payment method is swiping cards.

Credit cards

Credit cards can be a convenient way to collect payment. Everyone has them, the transaction is quick, and they’re secure. This is the preferred method for most farmers and most customers!

Credit card machines (you don’t want to be stuck doing manual input, so you need a swiper/chip reader) do require a steady internet connection. If you’re using a hotspot on your device or a spotty wifi system, you might lose the machine and have to go back to cash.

In addition to needing an internet connection, credit cards can have significant fees.

Payment tools (below) usually apply a fee either as a percentage of the total payment or a few cents per transaction (often both). Different cards also have different fees.

Our recommendation: Try credit card for on-site transactions, but have a backup plan if the internet connection is lost.

Tools for swiping credit cards

There are dozens of tools for taking credit cards payments. Most of them take a percentage and a few cents off of each transaction and have a separate hardware product for actually reading the cards.

Square

Square is an app/swiping tool combo that you can use by signing up for the system, downloading the app, and buying the swiper that plugs into a mobile device/computer.

The tool is easy to use and many small retailers like coffee shops have even begun using Square. It’s a great option for farmers markets, on-the-go payments, and other in-person sales. There are several functions that make Square our recommended tool. Square:

- makes receipts (hard copies and electronic versions)

- manages inventory

- can take payment offline

- provides a card reader

One potential downside is mandatory tech updates (when you have to purchase an updated piece of equipment). If this allows you to make more sales though, that cost might be justified! Square is also a bit more expensive than PayPal.

QuickBooks (Intuit)

QuickBooks allows you to enter information manually or by swiping a card (you need to get a card reader for this). This tool is going to be best for manual sales or sales from home. If you’re only doing a few sales this way (and especially if you already use QuickBooks), it’s probably going to be just as useful as Square.

Another upside of QuickBooks is that it’s easier for accountants to track since they can see the gross amounts and fees separately.

There are several challenges with QuickBooks, however. It only works if you use or subscribe to QuickBooks as your accounting system. It doesn’t take payments offline, and it doesn’t have it’s own credit card reader. Some farmers complain that QuickBooks takes too long to log in, slowing down sales. Finally, it has a higher percentage fee than other payment tools.

PayPal

PayPal transactions are instant and, like Square, offer the option to send receipts electronically. The fees are slightly lower than Square, but the most limiting factor of PayPal is that both users have to have a PayPal account. That means that you’ll probably need another option if PayPal is your main payment method.

If you’re going to be using PayPal in a time-sensitive sale, check out PayPal Here, which is faster. This is a good option for on-site sales.

Verifone

Verifone offers wireless swiping devices as well as PAYware Mobile, which allows you to swipe cards with an attachment for an iPhone.

Others

There are some other payment tools that you can use for on-site transactions. If you’re already using an accounting or payment system of some kind, see if they have a credit-card payment tool. If you have an existing account, it might be easier to setup and coordinate or could have reduced rates.

>>See a comprehensive list of mobile and counter-top credit card machines here

Tips

“Regardless of your choices, you need to make it easy to take an order, deliver it, and get paid. Your customers won’t want to make more decisions or get hassled with more questions.”

Your accountant may have recommendations and preferences for payment systems! Be sure to consider their preferences, since they will often be using the system.

Don’t forget about receipts! Many software platforms also offer a Bluetooth printer. You can also get wired plug-in printers if you don’t have an internet connection, and many tools offer email receipts.

Conclusion

If you’re selling on-site, you need a tool that’s quick and easy to use, secure, and that can send receipts when requested. Choose a tool that’s easy for accounting and that you can personally use and train others to use easily.

What are other farmers using?

What are other farmers using?

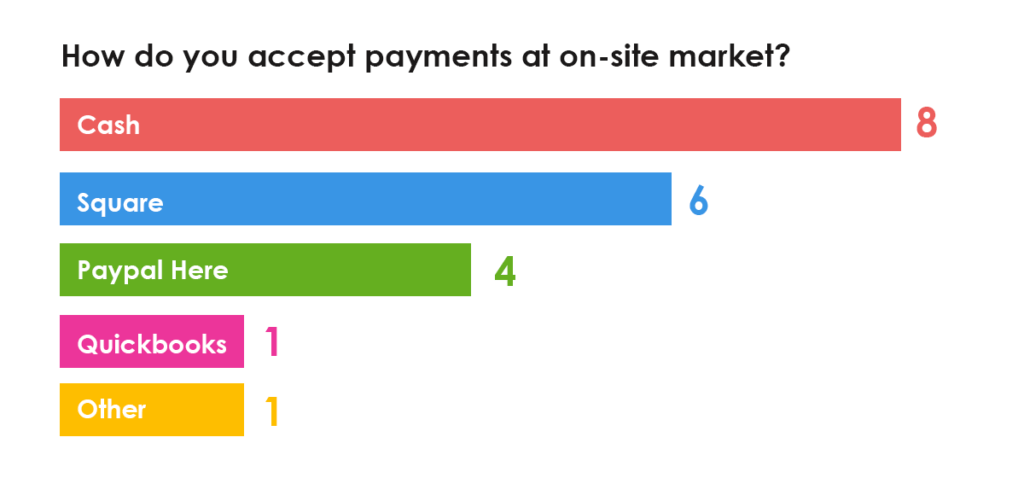

Eight of twenty farmers we polled use cash, while Square came in a close second at six farmers.

What do you use? Leave a comment and let us know!

Simply wish to say your article is as astounding. The clearness in your post is just great and i

can assume you’re an expert on this subject. Well with your permission let me to grab your

feed to keep up to date with forthcoming post. Thanks a million and please continue the enjoyable work.

Hey Halle can you create a poll like this for the USU Facebook forum to grab what they are using?

Hey Andy, the poll at the bottom of this post actually was from a Facebook poll. Let me know if you’re looking for something more specific.