When & how to get a farm bank account

So you’ve decided to start a farm and have wisely considered why you need to start a business account to handle your financial needs. There are plenty of decisions to be made, but with some patience, any farm can build the financial backbone required of any financial institution.

We’ll be exploring the when and how of starting a business account for your new farm. We’ve enlisted an industry insider to walk through the major steps of starting a business account, to explain the difference between types of financial institutions, what banks want from you, and how to find the perfect bank for your farm.

When should you get a business account?

This article was written with help from Emily Clarke of UniWyo Federal Credit Union, one of Laramie’s (Upstart University’s home base) best financial institutions.

The when of deciding to pursue a business account isn’t a very tough choice. You should begin looking for a business account the moment you have incoming funds approaching a thousand dollars.

Whether you have an angel investor coming through, or a formal bank loan up for approval, you’ll need a safe place to store those funds until you can begin making transactions. Don’t wait for the big financing to roll in. If you’re spending or receiving any amount near $1000, you’ll want a formal business banking account.

How to get your account started

There are a number of best practices that you’ll want to adhere to when shopping around for a bank or credit union. Before we dive into those specifics, let’s talk about the role banks play in small businesses.

What’s the difference between a bank and a credit union?

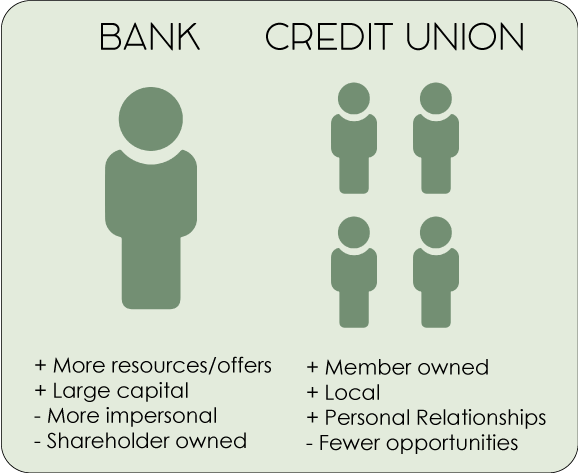

One of the major choices you’ll need to make when choosing a financial institution is between a bank or a credit union. The distinction is straightforward. A credit union is an organization (usually not-for-profit) owned and operated by its members. A bank is a more traditional business, owned and operated to generate profit for its stockholders. Here are the pros and cons of each.

A credit union, by virtue of being owned by its members, is going to be more focused on its community and local businesses. Where a big bank might see you as just another customer, the folks staffing and managing your local credit union will be neighbors.

Emily Clarke, one of UniWyo’s branch managers, notes, “as a member-owned business, a credit union’s goal isn’t profit but instead passing savings on to its members. The proceeds from loans and bank accounts are put back to work reducing interest rates and offering new services for our members.”

On the other hand, credit unions do not have the massive financial backing as the larger bank conglomerates. Specific types of loans, like small business or construction loans, might be beyond the means of a credit union.

On the other hand, credit unions do not have the massive financial backing as the larger bank conglomerates. Specific types of loans, like small business or construction loans, might be beyond the means of a credit union.

The biggest selling point for banks is scale. Most banks will allow for many more specific or niche loans and services, and extensive opportunities for funding in a variety of forms.

While likely not as focused on its individual clients as a credit union, banks are certainly going to offer a more uniform experience to small businesses. Banks large enough to be considered “business banks” (a non-standardized term) also have the perk of not needing to outsource their business loans, whereas smaller banks and credit unions must rely upon larger institutions to support their business clients.

Why do financial institutions want your business?

For those farmers working primarily at farmers markets, selecting a financial institution that will support digital transaction processing is essential.

Banks and credit unions don’t stand to make an enormous profit off of a small business owner. So why do they all want your business?

The most important thing for a bank or credit union is to form long-term relationships. While your personal or urban farm accounts might not represent a major influx of cash for their coffers, they want you to be happy with the services you’re receiving. A happy customer, no matter how small scale, means the potential for more business opportunities down the road.

While your farm might not be the big opportunity that represents a bank’s bread and butter, every financial institution will be eager to make you happy.

Tips for finding the right bank

Establish what you’re looking for in a bank or credit union

Choosing the right bank is a tricky endeavor. Every financial institution wants your business, and each bank will make an effort to persuade you to their side. However, not every financial institution is going to be the right bank for your farm. To make the right choice, you need to shop around. Consider what you’re looking for in terms of services, deals, and relationships. Visit your local banks and credit unions and try to get a sense for what each institution will offer.

Let the bank or credit union make the pitch to you

Remember that you’re the customer here. While you don’t want to waste anyone’s time, there’s no harm in shopping around! Let each bank’s small business representatives make the pitch to you. It also helps to know some local business owners who may have experience banking in your area. Rely upon these potential mentors for this essential initial decision.

Find a bank or credit union you’re comfortable with

At the scale of small farms, the best thing that a bank or credit union can offer is communication. Depending on the type of farm you’re running, you may have wire transfers, large cash withdrawals, and outwardly-suspicious deposits of bulk cash. In a number of different ways, banks are obligated to protect themselves and their customers and actively monitor for fraud and other nefarious activities. They might even suspend your access to critical funds under the auspices of protecting you! A bank protecting you is generally a positive thing, but without proper communication, these safeguards can backfire.

If you have a great relationship with your bank, your account manager can anticipate transactions and complications that might otherwise be put on hold or dealt with in a manner that could interfere with your business. You’ll want to select a bank or credit union that makes you feel comfortable and informed, and with which you can begin building a personal relationship.

The first date

After shopping around and choosing the right bank for your business, you’ll need to arrange the first meeting. Hopefully, you’ve already met, so you can get down to business. Your business account advisor will likely have an outline or plan to cover the basics, but you’ll want to be sure they cover the following:

- What sort of business you’ll be running (Corporation, Limited Liability Company, Sole Proprietorship, etc.)

- Employee or department accounts for specific use

- Business credit/debit cards—information on rates

- Tools to help with accounting

- Membership benefits

- Potential financing opportunities—loans, credit, etc.

Any financial institution will require identification, statements of intent, and the presence of all partners in your farm. Don’t be surprised if it takes a few meetings to organize all of the small details.

Find the right financial institution to jump-start your farm!

With a little patience and a lot of shopping around, finding the right bank or credit union to help start your farm is a simple task. Remember that financial institutions want your business and that you should carefully select the institution with which you believe you can form a strong relationship.

You’ve got some great tips for getting a business bank account. I like how you said that it’s important to look and find the right bank for your business or farm. Each one probably has different angles and strategies when it comes to banking, so I can see why it’s important to find one that fits whatever your business does.