Why farmers need separate bank accounts

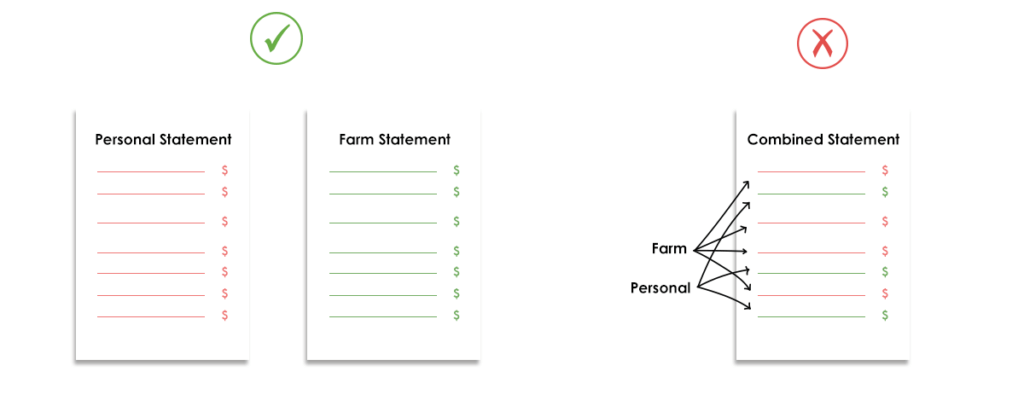

Many new farmers make the mistake of relying upon their personal bank accounts to organize their funds. Don’t! While it may be easier in the moment to use your personal account, it will complicate your life in the long run. Using your personal banking accounts to handle funding for a new farm can confuse your bookkeepers, make taxes difficult, and result in (accidental) embezzlement.

We’ve seen numerous (otherwise successful and competent) farmers struggle and fail because of poor financial foresight. In this article, we’ll discuss the importance of having a separate business account (a banking and checking account not associated with your personal accounts) to manage your money.

Farms are business

Any successful farm has to be a successful business. To keep your indoor farm alive, you’ll need to accept some realities of running a business.

From the outset, seek out a farm mentor to help you understand the choices you’ll need to make for a successful business.

Here are a few reasons why you need to have a separate business account:

Bookkeeping

The best reason to keep your personal and business accounts separate is to ease the strain of bookkeeping. Running a farm will involve tracking a multitude of expenses, and blending those expenses into your personal finances will make for a headache.

Consider the list of different financial expenditures that any given farm will encounter:

- Growing materials

- Tools & equipment

- Wages & benefits

- Marketing & labeling costs

- Energy costs

The list goes on. With a separate bank account, you won’t risk mixing your personal expenditures into the smorgasbord of business expenditures.

Minding your taxes

Taxes are such a challenge that most businesses outsource the labor involved in tracking the variety of funds, deductibles, and expenses. If you’re managing your own money, you also need to consider the potential risk of mixing your accounts. Once you begin selling a product to customers, you’ll need to track sales taxes, grocery taxes, and other potential pitfalls that might put you in the bad books with the IRS.

Keeping a business account separate from your personal account will help make sure you don’t accidentally misrepresent your finances.

Embezzlement, technically

When starting a new farm, the initial transactions may come out of your personal account. But when you’ve begun receiving investment funds, expenses, and travel costs, you need to be careful to avoid siphoning funds from the business toward your personal expenses. This goes doubly when you begin hiring new employees or bringing on partners to help expand your business.

Pulling from your revenue to pay for gas is one thing, but when you’re paying a partner and not compensating them for gas, then you’re embezzling company funds for your personal uses—even if it’s by accident. Skip the headache and get a second business account.

Family risk

Keeping your personal and business accounts mixed can expose you to risk due to relationships. There are two major risks:

1. Spousal Protection

1. Spousal Protection

If your business accounts are associated with your personal finances, your spouse may have the right to claim a significant amount of your business assets in a split. Hopefully, this is never an issue, but a simple answer to put your mind at rest is to keep your business accounts separate from your personal finances.

2. Business Partner Protection

Business partnerships can degrade over time for a number of reasons. There are several ways to plan a smart business partnership and using a separate business account is one of them. This will relieve personal financial risk in case of a partnership gone bad and will remove personal stress from a working relationship.

It’s not just easy, it’s common sense

While it’s tempting to skip a step and save yourself an hour or two at the bank, creating a separate account will save you money, discouragement, and time in the long run. On top of that, setting up a separate bank account is not hard—most banks can do it with you in a matter of hours. (More on how to set up a bank account in future posts).

The risk to your personal finances, the ease of accounting, and the peace of mind of a separate business account are worth any amount of paperwork. If you’re considering starting a profitable farm, make the right choice early in your farm’s life.

Get more guidance on farm finance and funding

Financial planning is a crucial step in starting any farm, whether big or small. A well-planned farm can foresee challenges and plan for the future. If you’re new and you want in-depth help with financial planning, consider getting a financial plan. This allows you to walk through a financial template for your farm asking all the important questions so that you don’t miss anything.

Grant for Farm